overview

Whatever the type of company, we can offer an appropriate cyber insurance service

From agile start-ups to multinational corporations, we know that the nature of cyber risk changes depending on the type of business. One size does not fit all.

Our knowledge of the cyber risk landscape gives us a deeper understanding of the different types of cyber risk – whether it’s the physical damage exposure of big industry or the high volume of patient records stored by a hospital.

What is cyber insurance?

The digital world is always evolving, resulting in cyber-attacks becoming more frequent and sophisticated, leaving more and more companies vulnerable to devastating consequences. Cyber insurance is a specialist insurance policy designed to protect your client’s businesses from financial losses caused by cyber-attacks. Our cyber insurance policies include cover for a range of threats including data breaches, cyber-crime, network security coverage and business interruption.

A cyber-attack can happen to any business, regardless of size or industry. By investing in cyber insurance, business owners can gain peace of mind knowing they’re protected against the fallout of a cyber incident.

What can happen during a Cyber Breach?

A cyber breach can cause immediate disruption to business operations, financial loss through ransom demands or recovery costs, and exposure of sensitive data such as customer records or intellectual property. It may also trigger regulatory investigations, legal liabilities, and reputational damage that can erode stakeholder trust. Recovery often requires specialist support and can take weeks, impacting productivity and long-term resilience.

Cyber Knowledge Hub

Whether you're exploring cyber insurance for the first time or you're a seasoned professional, our Cyber Knowledge Hub has something for everyone. Discover in-depth resources on topics ranging from "Why buy Cyber Insurance" to the opportunities and challenges presented by artificial intelligence.

Cyber Knowledge Hub

What cyber risks do we cover?

We cover a range of cyber risks with products designed to equip brokers and their clients with the ability to prepare for any eventuality.

Our cover helps your clients be protected against:

- Privacy and Security liability

- Regulatory Claims

- Breach Response

- Payment Card Industry coverage

- Cyber Extortion

- Business Income Loss

- Data Restoration

- Reputational Harm Loss

- Multimedia liability

products

Our cyber insurance products

In the dynamic and ever-evolving world of Cyber Insurance, it’s important to find a product that fits your needs. Explore our Cyber Insurance Products below and discover more about what Brit have to offer.

CPR for Small/Medium Business

Tailored for small to medium-sized businesses, our CPR service is perfect for a diverse range of industries. It is designed to offer you flexibility in insurance protection and cover Incident Response, Notification Services, and Insurance Protection.

XDR for Large Scale Business

Our XDR service is designed for large-scale and multinational corporations. Our solutions address a wide range of exposures, with a particular focus on network security, privacy, and data protection

risks.

BCAP for Industrial Business

Brit Cyber Attack Plus (BCAP) is our award-winning service specifically designed for industrial and trade businesses. This coverage bridges the gap between physical and non-physical risks and offers the largest amount of cyber capacity available in the market on a primary basis.

XDR Pro Tech for Tech Business

XDR Pro Tech is our specialised service tailored for the distinct requirements of technology-based companies. We offer customised policies for international enterprises that include Technology Professional Liability, Miscellaneous Professional Liability, Multimedia Liability, and Network Security and Privacy Liability.

First50

Our First50 product is a new initiative in the cybersecurity sector designed to facilitate the placement of cyber insurance for major institutional clients.

Brit FI Cyber Max is a Lloyd’s consortium delivering an integrated Cyber and Financial Institutions solution for large, complex Financial Institutions.

products

quick and easy access to our CPR product

cyber portal

All of our products are sold via intermediaries and insurance brokers. Brit has developed a portal for brokers to quote and bind products. If you are a broker you can log in here. If you're interested in our portal, please contact our e-trading team.

Read moreWhy do my clients need Cyber Insurance?

With technology advancing and becoming more deeply intertwined with daily operations, the rise in cyber threat is inevitable. Cyber insurance is now crucial, and insurance providers must provide adaptive coverage that precisely meets your client's unique requirements.

Across various sectors, regulatory bodies are tightening data protection standards. By embracing cyber insurance, businesses not only meet these compliance mandates but also signal a proactive stance towards risk management. This commitment not only safeguards against potential financial losses but also strengthens your clients' standing and trustworthiness within their industries.

Whilst GDPR has put the spotlight on data privacy and cyber issues, there are other more prominent trends that are driving a greater take-up of cyber insurance. When speaking to our clients, the growing frequency, severity and sophistication of the ransomware threat to their businesses has been their biggest concern and the true catalyst for cyber insurance adoption

Cyber Breach Response and Claims

Cyberattacks are increasing every year and they’re becoming more complex. That’s why we believe all organisations need to be prepared for a possible breach. Understanding how your insurance policy can help in the event of an attack and who to turn to for immediate support is critical.

Cyber Breach Response and Claims

DOWNLOAD

Datasafe

Our 3 stages of Cyber protection

Datasafe

Stage 1 - Ready

- Our Data Safe portal provides advice and the latest information on evolving cyber risks.

- Access our Knowledge Centre with over 500 compliance and risk management resources.

- Run a Cyber Fitness Check to assess your organisation’s cyber posture

Stage 2 - Set

- Use the confidential Virtual CISO to leverage unlimited advice from privacy and data security experts.

- Access Incident Response Planning resources with sample plans and procedures to help you feel prepared if a cyber event does occur.

- Keep your employees up to speed on key privacy and data security issues with online training courses and build ongoing awareness through bulletins, posters and webinars.

Stage 3 - Recover

- 24/7 Breach reporting hotline: our team of experts are on hand 24 hours a day to help you manage the potential consequences of a cyber threat.

- Our app provides a quick and easy notification process enabling you to report a breach promptly to our team of experts.

- Our expert claims team has thousands of breaches and claims behind them to get you back up and running.

Insights

Read the latest insights from our cyber security partners. You can find more news from our cyber team at the end of this page.

Insights

The NCSC’s Secure Connectivity Principles for OT

Read more

Why cyber risk matters for accountancy firms

Read more

Cyber Insurance: Your ticket to survival

Read more

Overcoming barriers to buying Cyber Insurance for SMEs

Read moreGoodbye Windows 10

Read more

The Open-Source Threat: What You Need to Know About OSINT

Read more

Tech E&O Explained: Risks, Coverage & Insights for Brokers

Read more

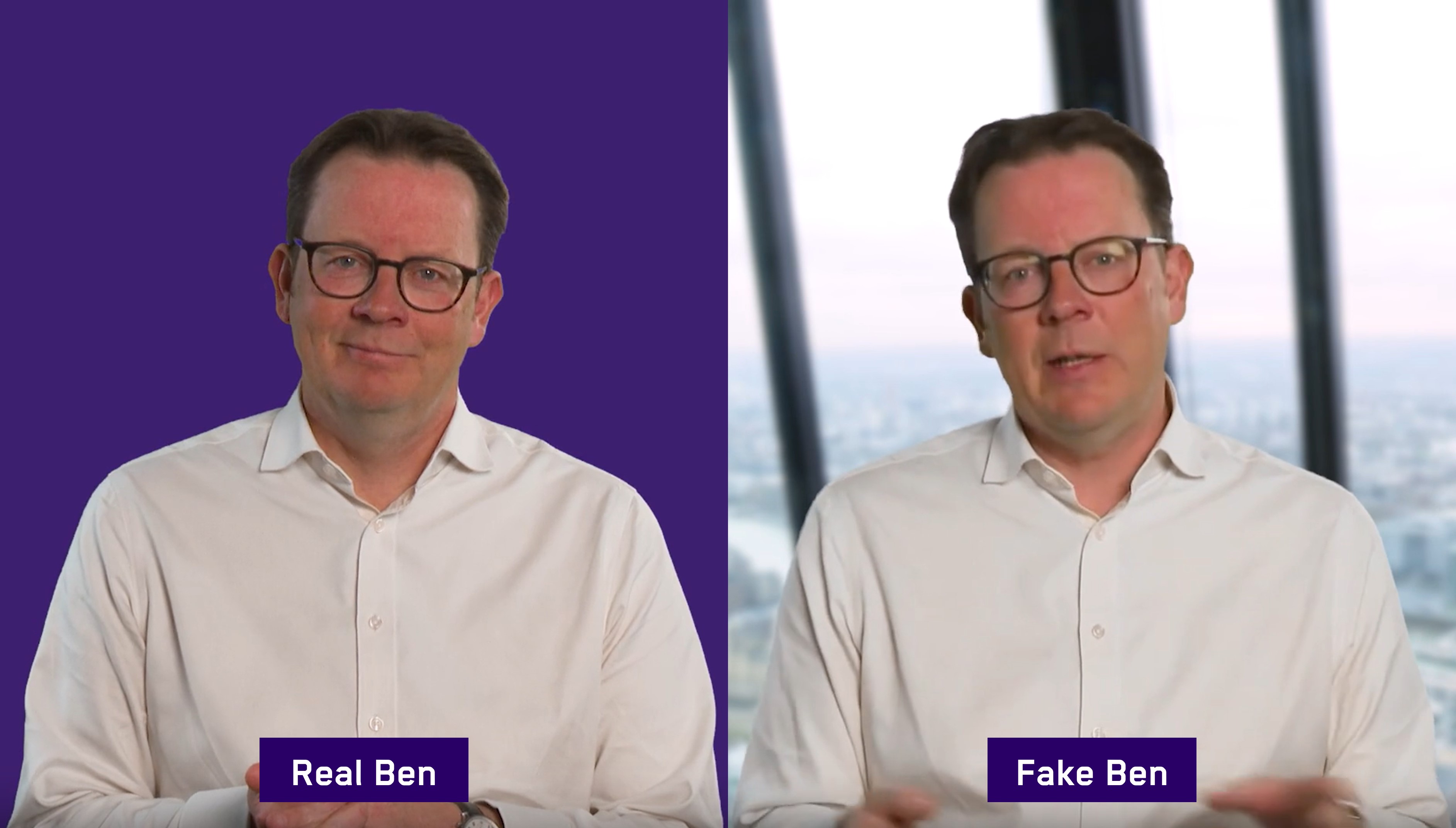

Dabbling with deepfakes

Read more

Consistently Inconsistent

Read more

Operational Technology (OT): Protecting Critical Systems in a Connected World

Read more

Digital Forensics: Managing a Digital Crime Scene

Read more

Breach response: leave it to the experts

Read more

Ben Maidment

Head of Global Cyber Privacy and Technology

faqs

What does Brit cyber insurance cover?

Brit’s cyber insurance can cover a wide range of risks including data breaches, cybercrime, network security failures, business interruption, cyber extortion, privacy and security liability, regulatory claims, and reputational harm.

Who needs Brit cyber insurance?

Brit offers tailored cyber insurance products for businesses of all sizes—from SMEs to multinational corporations and industrial sectors. Their CPR, XDR, BCAP, and XDR Pro Tech products are designed to meet the unique needs of different industries and businesses.

What makes Brit’s cyber insurance different?

Brit provides bespoke coverage backed by over 20 years of experience and insures 40% of the Fortune 500. Our services include a 24/7 breach reporting hotline, a mobile app for quick incident notification, and access to the DataSafe portal for training and risk management.

How does Brit help businesses prepare for cyber threats?

Brit’s three-stage protection model—Ready, Set, Recover—includes cyber fitness checks, virtual CISO support, incident response planning, employee training, and expert breach response services.